Wall Street is falling is falling… but the nations just may be getting a Jubilee Year as the debt crisis continues to rise and some banks go broke!

My friend Renato Cunha sent me this News Flash:

“The currency PEG’s signed between OPEC (Putin’s visit to Saudi Arabia & UAE on Putin’s visit yesterday) and the Central Bank of Russia’s chief Elvira Nabiullina brought an end to the petrodollar!”

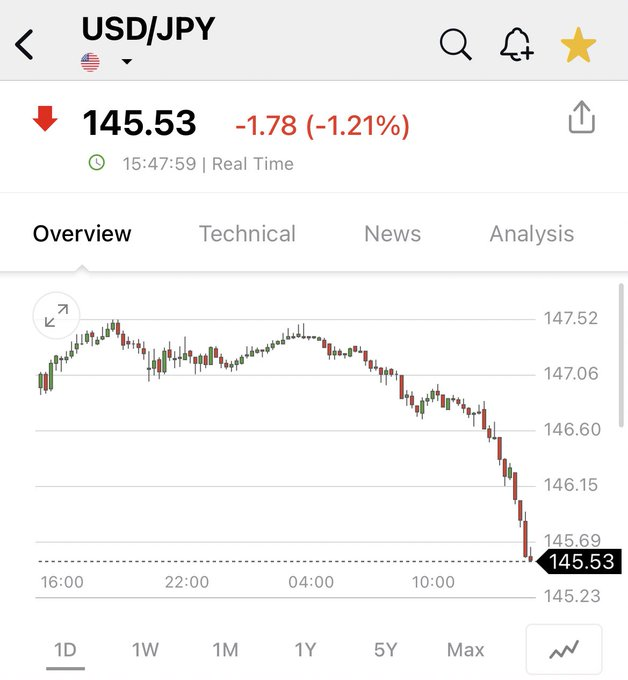

From MikeCristo8 on X: “The $1.1t of U.S. Treasury bonds held at the Bank of Japan, as the CARRY TRADE UNWINDS, The Bank of Japan has collapsed SoftBank collapsed, The Federal Reserve has now also collapsed, The signed PEG agreements (between OPEC) ending the petrodollar and ISO 20022 and Basel III have collapsed the $34t U.S. Treasury bonds, That’s why yields exploded on both the JGB 10yr and US10Y at the same time, Now expect massive monetary deflation, It’s over for the U.S. Dollar. U.S. Treasury bonds are now worthless. Gold will now move much higher and the oil price in dollar terms will collapse. This will now ALL unravel in the coming hours, a few days. -Cheers everyone.” MikeCristo8

So what does this all mean? Well many knew the air backed dollar was and has been in trouble and it only worked as long as the nations stayed in their boxes doing as they were told in order to trade and go green. It appears that another option that has been a long time coming is arriving and that is the BRICS Gold Standard. It appears to have pushed itself into the Saudi Kingdom via Putin and the BRICS.

I’m sure the chess moves Trump made with the U.S. Treasury while in office played a role in what is taking place in the US, and the defunct USA, Inc.

From the outside, what appears to be taking place is an alliance of nations for sovereignty that have made some persistent moves in their favor, out of the clutches of the IMF and the central bank’s petro dollar, along with all their green climate change mandates for nation borrowing. It looks like the only thing green is the green light to drill, drill, drill meaning oil and gas are here to stay!

An article from Business Insider, titled, “Saudi Arabia’s futuristic Neom project aims to embrace green flying taxis, but the world’s top oil exporter has no plans to phase down fossil fuels”.

It appears that while they are pushing the futuristic aspect of flying taxis and SMART futuristic cities in the desert…they are also not getting rid of their biggest national export. Read: Saudi Arabia’s futuristic Neom project aims to embrace green flying taxis, but the world’s top oil exporter has no plans to phase down fossil fuels (msn.com)

Barons Reported in an article titled, “Signs of Bank of Japan Pivot Slam Tokyo Stocks, Treasuries, and the Dollar Alike”, by Jack Denton, the following excerpts:

“Signs that the Bank of Japan may soon make a major monetary policy pivot have slammed Japanese stocks, Treasuries, and the U.S. dollar alike.

“Bank of Japan Deputy Governor Ryozo Himino on Wednesday hinted that any exit from the country’s ultra-loose monetary policy could actually benefit households, fueling speculation that such an exit could be in play. BOJ Governor Kazuo Ueda on Thursday said that monetary policy management would “become even more challenging from the year-end and heading into next year,” fueling further speculation.

“Ueda did not offer any clues regarding the timing of a potential exit, repeating that for now they will patiently continue monetary policy easing until the price objective is achieved sustainably and stably and with sufficient certainty,” said Charalampos Pissouros, analyst at broker XM.

“Investors are now pricing in a 37% chance that the BoJ are going to end their negative interest rate policy at the meeting on December 19, and at one point overnight that even got as high as 45%,” noted Henry Allen, an analyst at Deutsche Bank.

“Tokyo’s benchmark Nikkei 225 index sliding 1.8% on Thursday to see its worst day in more than a month. The yen, meanwhile, gained 1.5% against the dollar, sending the U.S. Dollar Index—which measures the greenback against a basket of peers—down 0.2%. There has also been an impact on Treasury yields. Japanese investors are major buyers of U.S. government bonds, and a move out of negative interest rates in Japan would be expected to temper that demand somewhat. The yield on the 10-year U.S. Treasury note rose as high as near 4.19% after finishing Wednesday below 4.11%.” Read full article: Signs of Bank of Japan Pivot Slam Tokyo Stocks, Treasuries, and the Dollar Alike (barrons.com)

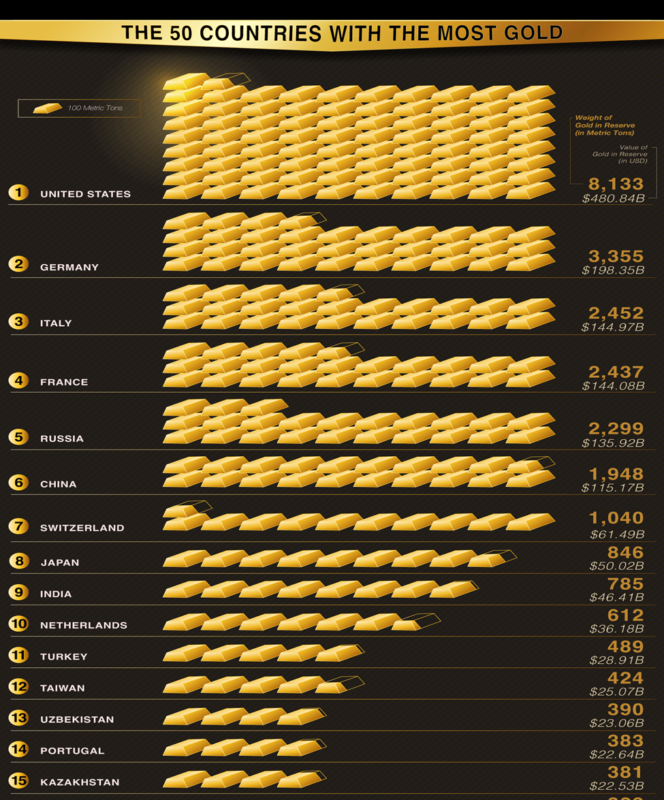

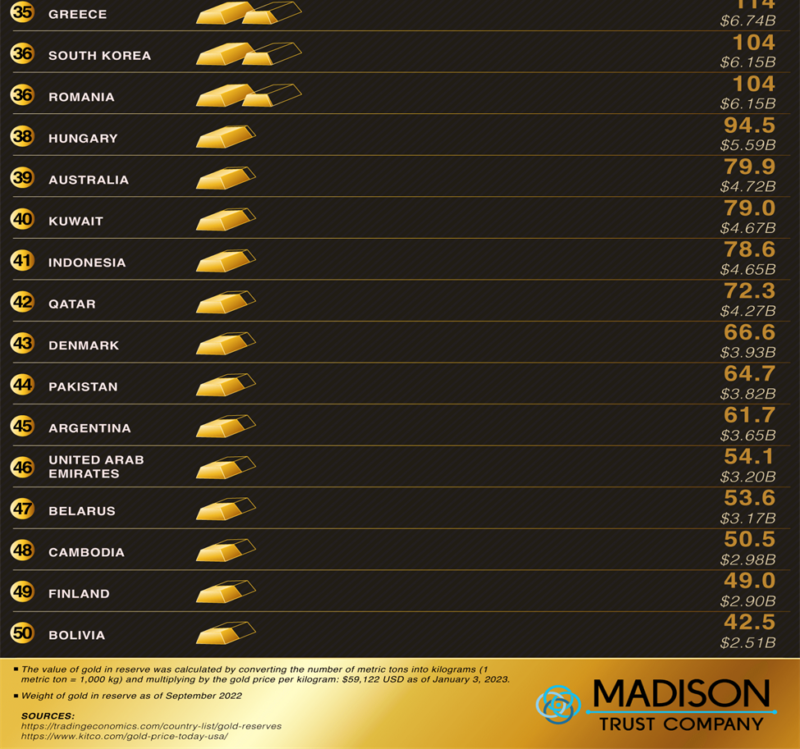

It appears that rather than collapsing the nations are pivoting and repositioning what backs their dollar… gold standard seems to be the end goal whether IMF likes it or not.

I didn’t see Israel Gold Reserves listed, so I did a bit of digging and was very surprised to find that this fire starter that wants to genocide an entire race has O, that’s zero gold reserves????

Israel Gold Reserves

1950 – 2019 | MONTHLY | USD MN | CEIC DATA

Key information about Israel Gold Reserves

- Israel Gold Reserves was reported at 0.000 USD mn in Feb 2019

- This stayed constant from the previous number of 0.000 USD mn for Jan 2019

- Israel Gold Reserves data is updated monthly, averaging 3.425 USD mn from Dec 1950 to Feb 2019, with 753 observations

- The data reached an all-time high of 61.915 USD mn in Mar 1964 and a record low of 0.000 USD mn in Feb 2019

- Israel Gold Reserves data remains active status in CEIC and is reported by CEIC Data

- The data is categorized under World Trend Plus’s Global Economic Monitor – Table: Gold Reserves: USD: Monthly: Middle East and Africa

The International Monetary Fund provides monthly Gold Reserves in USD. Read: Israel Gold Reserves, 1950 – 2023 | CEIC Data

So what do you think is taking place in Israel and the entire gold thing? If you have no gold, the last thing you would want to be on is a gold standard. Wouldn’t you? Ponder it… this sure looks like a puzzle piece of something???

Knowing how these games are very serious and the KM Oligarch fight below the belt will leave a lot of drunkard type actions flying around, so brace yourself for any and all sorts of retaliation. Don’t discard WWIII getting a bit more explosive, especially with the Israeli, Hamas war and all the shouts of ethnic cleansing. Pray the wicked ones are intercepted and the WEF and their depopulation push also gets reigned in and snuffed out. The world being run by unappointed tycoons in the shadows via their appointed mouth pieces are coming to a head. It just isn’t sustainable now that people are waking up world wide.

That being said, what message was sent to the world by the welcome Saudi gave their recent guests…?

If you want to know how ridiculous the Biden Regime is on the world issues… you can hear Kirby as he tells the press absolutely nothing.

So you can blow up hospitals, kill children, cut off water and electricity and that doesn’t violate any deals? Deals? Oh my head hurts.

Does this mark a milestone in history… like perhaps the end of the Rothschild Central Banks?

The only thing better than this was Trump’s welcome in 2017.

That being said, we have the leader of Israel bragging that he has the 2.0 Biden in the palm of his hand???

Maybe we can send Biden to Israel and Netenyahu can have all of him all of the time? I think ole Joe said the same thing about Net? Or am I thinking of Corn Pop? Not sure, so don’t quote me on any of that. Smile.

Wonder what “all of the threats” means? I understand all of the time. What are the threats he speaks of? All of them?

And…. shifty Schiff is done. It’s over for him. Is he a 2.0 or still a 1.0?

KEEP ON PRESSING INTO THE KINGDOM OF GOD! PRESS, PRESS, PRESS!

DIANNE