Brought to you by the Rothschild owned Central Banking System!

On Saturday, March 18th, Judy Byington reported a number of global updates. She stated, “We are in a Black Swan Global Economic Crisis Event due to failure of the Central Banking System. There were 173 Banks around the World that failed this week – and went unreported by the Mainstream Media.”

The Storm is Upon Us …

*Stock Market – Strained, * 173 Banks – Failed this Week, *Biden Crime – Exposed *Epstein – Exposed, *Jan. 6 – Exposed, *US Dept. Of Defense Bio-weapon labs in Ukraine – Exposed, *Ukraine Nazi – Exposed, *COVID 19 – Exposed!

Let’s add to her list – drug and human trafficking dark money laundering bust! And assets to be confiscated!

It’s so bad now that even CNN is willing to report on the Bidens rather than to touch SVB. They just report a run on the bank for some bla, bla, bla reasons.

But for now… back to the bank fails….

As we have said many times, the BRICS nation’s “Currency Reset” to a gold backed dollar that is now becoming wider accepted across the world, is the one thing that can and undoubtedly will save the US from the deep state global plans to destroy the world economy and put the nations under their dictated tyrannical order and their social credit digital system.

Presently, 163 Rothschild Banks are in a controlled collapse, including the US Federal Reserve:

Since Fri. March, 10, 2023, the unrealized losses of US Banks that have failed – including the now officially bankrupt Silicon Valley Bank (SVB) – was over two trillion dollars, meaning that two hundred more US banks would fail if people asked to withdraw their money. Two of the three big banks that failed last week were Signature Bank, and Silicon Valley Bank. Following the failed Alameda State Bank in October. These three were the main source of Crypto Currency.

So what went wrong to cause the banks to fail? Did it start at one, several? Was it a domino affect or did depositors have assets confiscated or just what took place to start the fall?

A lot of Silicon Valley Bank depositors were founders of tech startups and companies. (Pay attention to the words “founders of tech startups and companies.) Too many people tried to withdraw their money at the same time, and the bank became insolvent — its liabilities exceeded its assets. Now think, why would people withdrawl that much of their money at the same time? (Remember… the shareholders also dumped their stocks!) Remember who committed election interference with fact checking, banning, and mis and dis information on social media, online apps, servers, software programs and tech services. And don’t forget all the dark money laundering for drug and human trafficking, weapons and other dark biolab things.

And then remember what happened to the second largest stock holder of Twitter, who was Prince Alwaleed whose assets were all confiscated by the Saudi Government after the failed assassination attempt on Prince Salman in Las Vegas in 2017 and other corruption. A host of other royal Saudi Princes were also detained on corruption charges and assets confiscated and turned over to the Saudi Government. The news of Alwaleed no longer owning Twitter stock came out during the Elon Musk purchase negotiations. Inside the Arrest of Saudi Arabia’s Alwaleed Bin Talal | Time But then Las Vegas, and that entire situation is another story. Secrets Of The Mandalay Bay Las Vegas Massacre: The Truth About The Coup & Coverup (biselliano.info)

The point is, nothing is ever as it appears, especially when it has to do with powerful people. Up until that all happened, Prince Alwaleed was known as the Warren Buffet of Saudi. So sometimes when stocks are sold and money is withdrawn from a bank, there are other reasons, many are dark reasons.

And when the same thing happens all at once to many big banks … it raises some questions, a lot of them.

Signature Bank also had a large percentage of uninsured deposits. Many depositors of Signature Bank began taking out money from their bank accounts. Regulators decided to shut the bank down two days after closing Silicon Valley Bank.

And Then there is Credit Suisse…

Credit Suisse– a “Too Big To Fail” deep state cabal Bank in Switzerland – was collapsing and on Friday March 17, 2023, it was said to have been purchased by the Union Bank of Switzerland, (UBS). The Swiss Finance Minister stated that UBS Buying Credit Suisse Is Not a Bailout, it is a commercial solution and UBS is taking over. The Finance Minister, Karin Keller-Sutter, stressed it was not a bail out and they really wanted to find a solution and buying it was the best solution.

Read: UBS to buy Credit Suisse for nearly $3.25B to calm turmoil (msn.com)

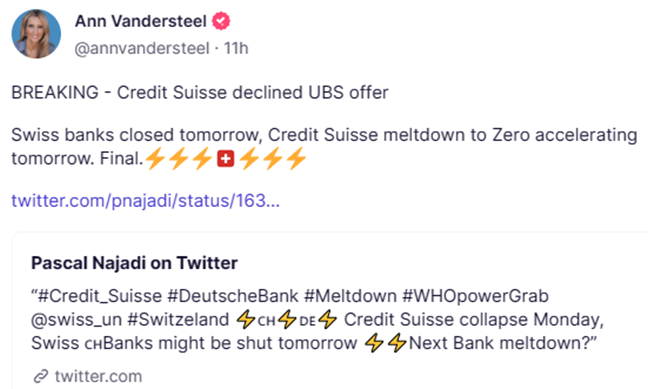

Then later word traveled via social media that Credit Suisse refused the offer from UBS and was having a credit melt down to zero.

BUT THEN FORTUNE SAID…..

Credit Suisse’s $17B of risky bonds now worthless after takeover by UBS: ‘Those bonds were created for moments like this’

BYTASOS VOSSOS, COLIN KEATINGE AND BLOOMBERG

March 19, 2023 at 3:05 PM CDT

FABRICE COFFRINI/AFP VIA GETTY IMAGES

Fortune wrote, “Holders of Credit Suisse Group AG bonds suffered a historic loss when a takeover by UBS Group AG wiped out about 16 billion Swiss francs ($17.3 billion) worth of risky notes.

“The deal will trigger a “complete write-down” of the bank’s additional tier 1 bonds in order to increase core capital, Swiss financial regulator FINMA said in a statement on its website. Meanwhile, the bank’s shareholders are set to receive 3 billion francs.

“The bond wipe out is the biggest loss yet for Europe’s $275 billion AT1 market, far eclipsing the only other write-down to date of this type of security: a €1.35 billion ($1.44 billion) loss suffered by junior bondholders of Spanish lender Banco Popular SA back in 2017, when it was absorbed by Banco Santander SA for one euro to avoid a collapse. In that instance, the equity was also written off.

“In a typical writedown scenario, shareholders are the first to take a hit before AT1 bonds face losses, as Credit Suisse also guided in a presentation to investors earlier this week. That’s why the decision to write down the bank’s riskiest debt — rather than its shareholders — provoked a furious response from some of Credit Suisse’s AT1 bondholders.” Read: Credit Suisse’s $17B of risky bonds now worthless after takeover by UBS: ‘Those bonds were created for moments like this’ | Fortune

So UBS deal went through, it just didn’t save the bond holders…and did little for the bank. POOF -THE AIR WAS DEFLATED out of the central banks vaults. Credit Suisse fell very fast too. Why and who pulled their money out fast? Why did the Swiss billions over the top of dead bonds? Why did they do it so fast and why did they make sure EVERYONE knew it WAS NOT A BAIL OUT? Why did they say it was commercial?

Meanwhile …

On Fri. 17 March a big fire broke out in the center of English Loughborough: the building of HSBC bank, which recently bought the British division of the bankrupt Silicon Valley Bank. What were they burning?

And then there was the ‘Too Big To Fail’ European Bank on Brink of Collapse: A Bank in Europe is Literally on the Brink of Collapse | Dinar Chronicles

Bank Stocks Price Crash: (First Republic Bank, Western Alliance & More) https://beforeitsnews.com/economy/2023/03/bank-stocks-price-crash-live-news-coverage-first-republic-bank-western-alliance-more-3080571.html Several bank stocks are crashing, including First Republic Bank, Western Alliance, and more, in the aftermath of the Silicon Valley Bank and Signature Bank closings.

See: Bank Failures: a List of Failed Banks (businessinsider.com)

If you only follow the bankers and all the sell offs and stick to fake news bank reports… you will miss a lot of what is really going down. No one knows how this is going to land…but Trump said it best as he said, it will be 1929 and worse. But it is looking like it will be the money launderers who suffer the biggest hits and damage. Tick Tock!

Listen to this take on the bank fail which is very interesting…. Pandora Papers? Drug money? Dark deals? Take a look.

Silicon Valley Bank when under, Israel made a big profit and New Hampshire is the biggest fentanyl cartel in the states! They are afraid of Trump! I’m sure they know he has the military with him! They know he’s the real president. Why else would they run and hide their money and their evidence so fast?

I’m thinking the crooks are busted!!!! Drug and dark money laundering banking 101!

Discern all podcasters and opinions on social media. However, dig to find some gems like the one above that offer you some food for thought. Stay focused on good sources and don’t let the fear psyops get to you. That will drain your energy. Get what you need for supplies… and pray unceasing as our Father in heaven has all of this in his hands. We are in the storm and there is a plan in place. Don’t let the fall of the cabal stress you.

Keep on pressing into the Kingdom of God. Press, press, press!

Dianne