U.S. dollar (USD) LIBOR (London Interbank Offered Rate) panels will end on June 30, 2023!

What does this mean? It means that the present LIBOR banking system has been transitioning away from the LIBOR increasing rate system in preparation for a new rate system.

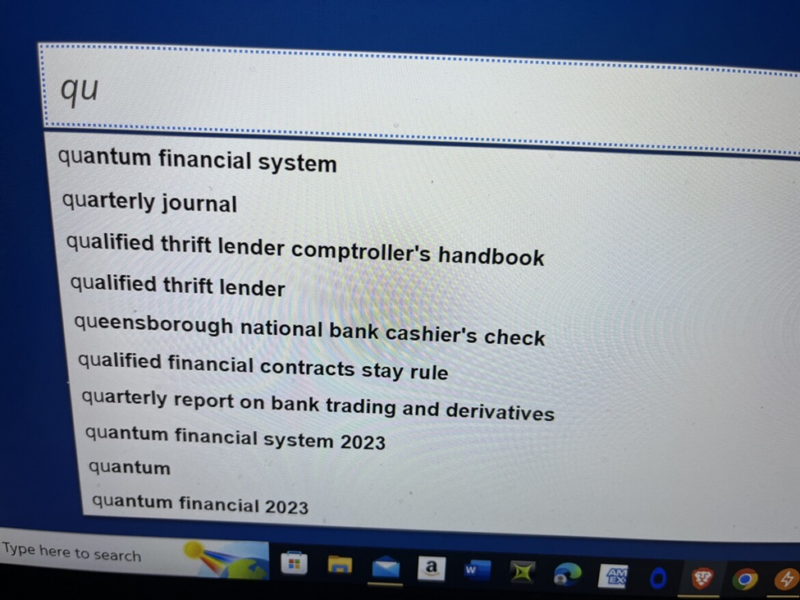

(Some rumors have it that this is a new digital currency system and hoping it to be the end of the Central Banking System’s Fiat petro dollar and the transition into a new gold backed dollar system. But, so far none of that has been announced nor confirmed.) Some are a bit more scary to listen to than others.

In October 2021, the OCC and other federal banking agencies, in conjunction with the state bank and state credit union regulators, issued a statement to emphasize the importance of an orderly transition away from the London Interbank Offered Rate (LIBOR). The statement highlighted that the failure to adequately prepare for LIBOR’s discontinuance could undermine financial stability. The federal banking agencies separately warned that a disorderly transition away from LIBOR, including the use of LIBOR after December 31, 2021, could create safety and soundness and consumer protection risks.

The agencies are advising banks to have taken all necessary steps to prepare for an orderly transition away from LIBOR by June 30, 2023.

- Banks are encouraged to ensure that replacement alternative rates are negotiated when needed for all LIBOR-referencing financial contracts. Banks are also encouraged to work expeditiously with their customers and coordinate with other banks as needed in these efforts.

- Banks are reminded that safe and sound practices include conducting the due diligence necessary to ensure that alternative rate selections are appropriate for the banks’ products, risk profiles, risk management capabilities, customer and funding needs, and operational capabilities.

From The Office of the Comptroller of the Currency (OCC)

WASHINGTON—Acting Comptroller of the Currency Michael J. Hsu today issued the following statement on the publication of the Office of the Comptroller of the Currency’s (OCC) Semiannual Risk Perspective Spring 2023 report.

The Semiannual Risk Perspective (SARP) for Spring 2023 highlights key risks facing the federal banking system – risks that we expect bankers to be attentive to and prudently manage, and that reflect our priorities as supervisors of national banks and federal thrifts.

Since March, the OCC has been closely monitoring the conditions of the institutions we supervise. The federal banking system is sound, and deposits are safe. Notably, national banks and federal savings associations (banks) have strengthened their liquidity to cover potential deposit withdrawals.

Looking ahead, the OCC expects banks to “be on the balls of their feet” with regards to risk management, just as our examiners are. This means banks should be:

- guarding against a false sense of comfort from the recent relative stability in bank markets and from the benign credit performance data over the course of the pandemic,

- re-evaluating exposures, especially asset and liability concentrations, across a range of scenarios,

- taking actions to preserve capital and maintain strong liquidity consistent with each bank’s risk profile,

- maintaining discipline and strong risk management across all risk areas, not just in response to headlines, and

- preparing to communicate clearly, credibly, and promptly about their condition and risk profile should questions arise from customers, investors, depositors, and other stakeholders.

Most of the banks we supervise are doing these things. Maintaining such vigilance can be challenging, though. That is why it is critical for us all to continue to guard against complacency.

This issue of the SARP highlights liquidity, operational, credit, and compliance risks. Liquidity positions have been strengthened in response to the turmoil in the first quarter of this year, but risks from elevated interest rates continue. Credit risk in aggregate remains moderate, but signs of stress are increasing, for instance in consumer credit and certain segments of commercial real estate. Operational risk is elevated, as cyber threats persist, and the digitalization of banking products and services expands. In addition, banks need to be vigilant about addressing accumulating “technology debt” from legacy systems and deferred IT maintenance. Compliance risk is also highlighted, given the dynamic environment in which compliance management systems are challenged to keep pace with the change.

Summary

The Office of the Comptroller of the Currency (OCC) and other federal financial institution regulatory agencies (collectively, the agencies), in conjunction with the state bank and state credit union regulators, today issued a joint statement to remind banks that U.S. dollar (USD) LIBOR panels will end on June 30, 2023, and to emphasize that it is important that banks with USD LIBOR exposure complete their transition of remaining LIBOR contracts as soon as practicable. Failure to adequately prepare for LIBOR’s discontinuance could undermine financial stability and banks’ safety and soundness and create litigation, operational, and consumer protection risks.

What is the Office of the Comptroller of the Currency (OCC)?

The Office of the Comptroller of the Currency (OCC) was created as a bureau of the U.S. Department of the Treasury by the National Currency Act of February 25, 1863.

The OCC has steadfastly served the American public for 160 years by ensuring the federal banking system is safe and sound, provides fair access to financial services, treats customers fairly, and complies with applicable laws and regulations.

The Beginning – Founded in 1863

President Lincoln recognized that unreliable paper money and inadequate credit was problematic. Along with his Treasury Secretary, Salmon P. Chase, he conceived the national banking system and the Office of the Comptroller of the Currency to regulate and supervise it.

On February 25, 1863, President Lincoln signed The National Currency Act into law. The Act established the Office of the Comptroller of the Currency (OCC), charged with responsibility for organizing and administering a system of nationally chartered banks and a uniform national currency. In June 1864, the legislation underwent substantial amendment and became known as the National Bank Act. Modified and supplemented over the years, the National Bank Act continues to provide the basic governing framework for the national banking system today.

Hugh McCulloch: OCC’s First Comptroller

OCC Through the Years 1863 – 1865

1863-1865: Founding of the National Banking System

The story of the Office of the Comptroller of the Currency and the national banking system begins in 1863, when the National Currency Act was passed by Congress and signed into law by President Abraham Lincoln.

1866-1913: The System in Operation

Of the 1,600 state banks that existed in 1860, only 300 remained by 1866, while the national banking system shot ahead in numbers and influence.

1914-1935: Years of Transition

The passage of the Federal Reserve Act in 1913 was a watershed in U.S. banking history. It created the Federal Reserve System, with a network of branches in large American cities, tied together by a Board of Governors.

1936-1966: Stabilization & Challenge

World War II, signaled the end of the Great Depression. National service pulled many bank examiners off the front lines of supervision and moved them to the front lines of combat. Fortunately, with the emphasis on lending to government rather than individuals, bank safety and soundness was never compromised.

1967-2007: Information Revolution, Prosperity, Warnings

The closer integration of America and the world brought changes to the OCC as well as to the industry it supervised. Communication improvements meant faster and more consistent decision making across the OCC.

2008 – Present: Crisis, Reform, and Recovery

Despite the warning signs, no one expected the worst financial crisis since the Great Depression. The year 2008 saw the first ever annual decline in housing prices, along with record foreclosure levels and heavy losses on subprime loans.

What OCC Does

The OCC ensures that national banks and federal savings associations operate in a safe and sound manner, provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations.

Supervise & Examine

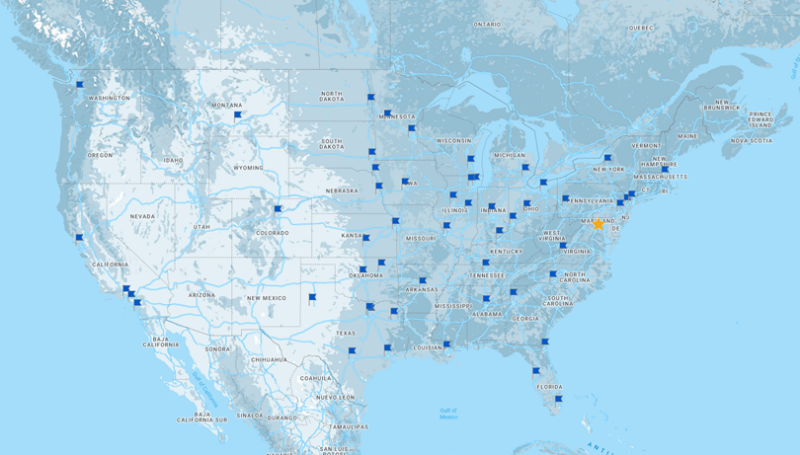

- The OCC provides high-quality, fair, and balanced supervision to its chartered banks.

- Our well-trained examiners conduct on-site reviews of banks and provide ongoing supervision of the banks’ operations.

- Examiners meet with bank management and the bank’s board of directors throughout the supervisory cycle to obtain information or discuss issues.

- The “Bank Supervision Process” booklet of the Comptroller’s Handbook describes our risk-based approach to bank examinations and details virtually all aspects of bank supervision.

Regulate & Enforce

- The OCC is the primary regulator of banks chartered under the National Bank Act and federal savings associations chartered under the Home Owners’ Loan Act.

- The OCC issues rules and regulations that govern the banks it supervises.

- The agency takes supervisory actions against banks that do not comply with these statutes or that otherwise engage in risky practices.

- The “Supervisory Actions” section of the “Bank Supervision Process” booklet of the Comptroller’s Handbook outlines the actions that the OCC may take.

Charter & License

- Financial institutions follow an in-depth application process to be chartered as an OCC-supervised bank.

- Chartered banks apply to the OCC to make substantial changes to their activities or structure.

- The OCC evaluates the applications to make sure banks’ corporate structures are established and maintained in accordance with the principles of a safe and sound banking system.

- Our licensing department works closely with the agency’s supervisory and legal divisions to render independent decisions regarding applications.

Protect Consumers & Communities

- Ensuring fair access and equal treatment to bank customers is a fundamental part of the OCC’s mission.

- The OCC helps banks be leaders in safe and sound community development financing and making financial services accessible to underserved communities and consumers.

- OCC examiners make sure banks comply with consumer banking laws.

- The OCC operates HelpWithMyBank, a website that assists bank customers with common banking questions and lets them file complaints against a national bank or federal savings association.

OCC Strategic Plan, Fiscal Years 2023-2027

Click link to read Strategic Plan: https://occ.gov/publications-and-resources/publications/banker-education/files/pub-occ-strategic-plan-2023-2027.pdf

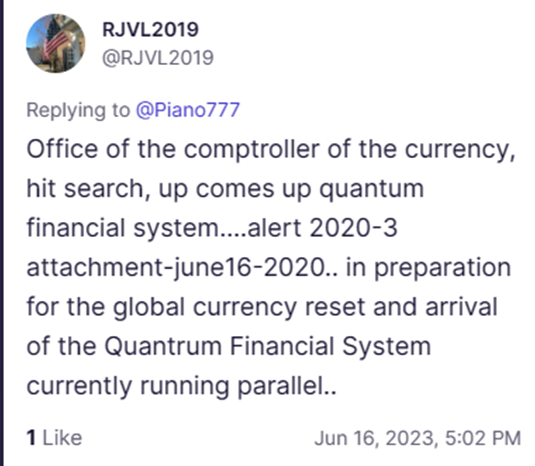

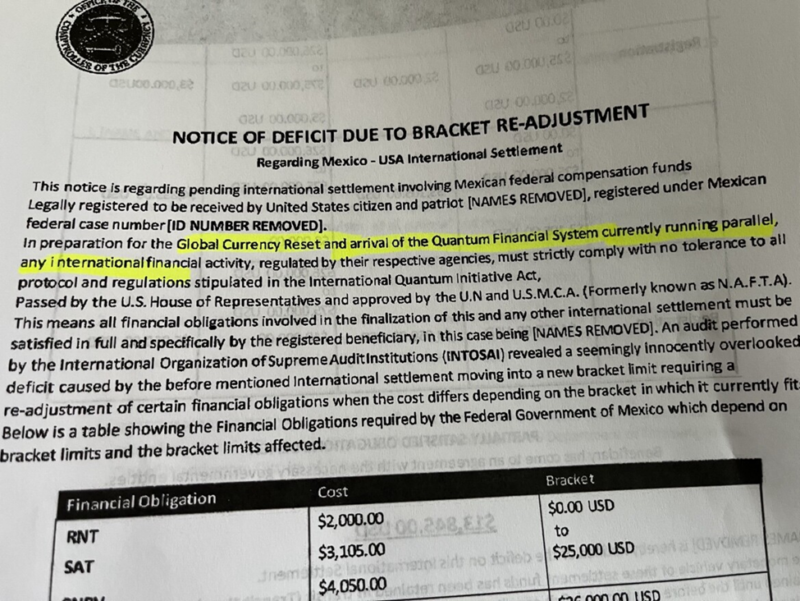

Some say this is the arrival of the Quantum Financial System and is currently running parallel with our present system. Whereas there is a transition underway… and all things point to the gold backed dollar… I hesitate to make any claims about who, what, when or where… or whether it will be the “Quantum Financial System” that Klaus Schwab wants or another type. I shudder to think of America if we get the one the World Economic Council in DAVOS is pushing for. I know there is a system transitioning. The question is which one will we be using? Read: The world is heading for a ‘quantum divide’: here’s why it matters | World Economic Forum (weforum.org)

From five months ago… a good explanation of what the LIBOR transition is and what the banks are doing.

I want to give a special thank you to RJVL2019 on Truth Social for sharing his quantum financial system information alert with me. We are headed for something big, and the information provided is eye opening. Of course my hope is that after the storm, we will land with a gold backed dollar, a National Bank and end the Fed. Please go to the Office of the Comptroller of the Currency website and dig around. About | OCC Also checkout links above.

This is already being prepared for individuals as RJVL2019 on Truth Social has shown here.

Related Link

KEEP ON PRESSING INTO THE KINGDOM OF GOD! PRESS, PRESS, PRESS!

DIANNE