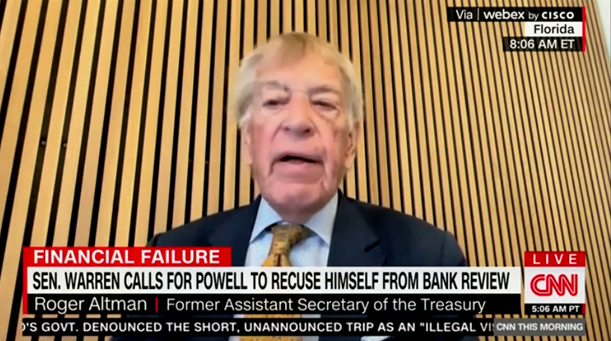

Former Assistant Secretary of the Treasury, Roger Altman stated today that the depositors are guaranteed protection and this is a breath taking step!

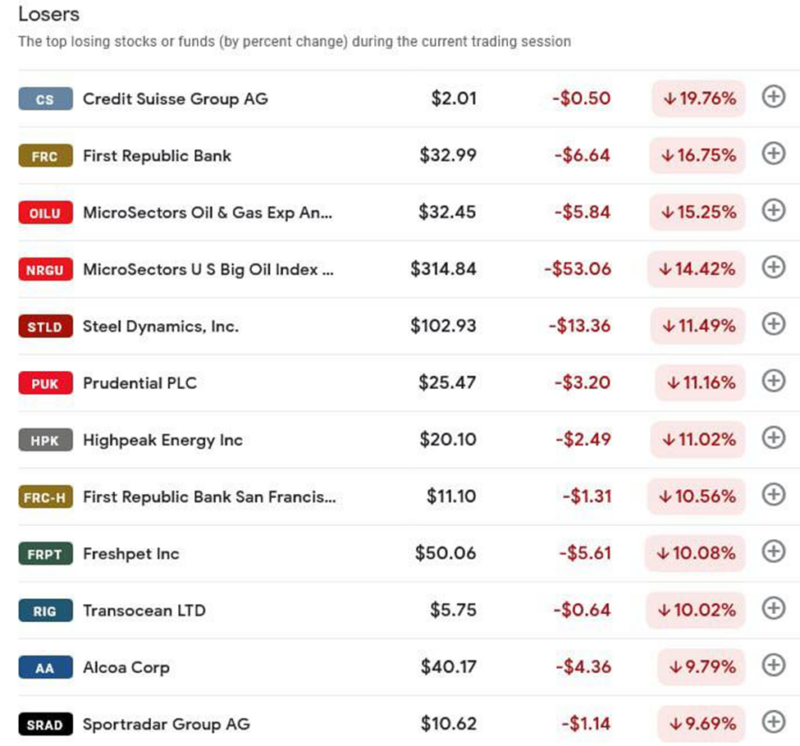

As the banks are failing, and stock holders are losing their ground a chain reaction of bank fails are looming and giving a lot of ideas as to what is taking place.

Former Assistant Secretary of the Treasury, Roger Altman responded to the unique circumstances and steps being taken noting that depositors are protected but share holders are not which indicates a very interesting possible potential outcome.

“This is a breath taking step that affectively naturalizes or federalizes the banking system. Guaranteed protection for deposit holders, nationalizes or federalizes the deposit base of the US financial system.

“Now …a…you can call it a bail out or you can call it something else, but it’s really absolutely profound. Now the authorities, including the White House are not going to say that, and what I just said, of course implies that they’ve just nationalized the banking system. And technically speaking, they haven’t, but in a broad sense, they’re verging on that.”

“By the way, the shareholders in Silicon Valley Bank obviously lost all their money. Therefore, if you’re a shareholder at First Republic or some of the other banks that you showed on your screen a few minutes ago, you’re concerned because you saw that the Silicon Valley Bank shareholders were wiped out. But the depositors in the institutions have nothing to worry about because they have just been guaranteed.“

When questioned on his calling the banks nationalized… Altman responded…

“I didn’t say it has been nationalized, I said it was verging on that because they have guaranteed the entire depositors . Usually the term nationalization means that the government takes over the institution and runs it and the government owns it. That would be the type of nationalization you would see in many other countries around the world. That did not happen here. But when you guarantee the entire deposit base, a… you have put the federal government and the tax payer in a much different place in terms of protection than we were in a week ago.”

That being said… it sure lends the appearance that this could well have a lot to do with President Trump’s Executive Order and asset confiscation due to election fraud, as it has already been proven that Silicon Valley’s high technology Social Media groups and international investors have contributed to election interference and the web of that is highly sophisticated and reaches across international lines.

Which leaves the idea that President Trump’s EO could have seized all the banks and in a way nationalized them under the U.S. military protecting the depositor base and seizing assets of others? This could have reversed the underhanded dealings of the Bank of England and the Vatican bank when they “nationalized” our banking system in 1871 and placed it under their control.

JUST IN – First Republic Bank downgraded to “junk” by S&P.

In an article today by “Market Watch”, it was stated that the First Republic Bank’s deposit base is more concentrated than most large regional banks and portion above FDIC’s $250,000 threshold at risk of withdrawal.

They reported, “First Republic Bank absorbed debt rating downgrades from two bond rating firms Wednesday, as concerns mounted it will suffer further deposit flight that will hurt its already modest profitability.

“S&P Global Ratings downgraded its issuer credit rating on First Republic Bank by four notches to BB-plus from A-minus, placing it in speculative grade, or ‘junk,’ status, in a move that came just hours after it put the bank’s debt on review. Read full story here: First Republic Bank downgraded to ‘junk’ by S&P and Fitch on fears further deposit flight will hurt profitability | Morningstar

In the UK: HSBC building engulfed in flames as major fire breaks out in Loughborough town centre!

Multiple fire crews are responding to the blaze from all around Leicestershire. People are urged to avoid the area while the response is ongoing.

NOW just how did that catch on fire and why? Interesting. I bet they had insurance!

Oh and in May of 2021, HSBC had withdrawn from US retail banking. Why was that? They said they couldn’t compete…but with what?

Read: HSBC withdraws from US retail banking | Financial Times (ft.com)

Meanwhile … A picture is worth a thousand words…

Where a picture is worth a thousand words… I am wondering what words this could bring to ones mind? Whereas, nothing is as it appears, while I still have free will and a brain to critically think with, hackable animals and chips come to my mind. But, it is the imagination that can send a flurry of ideas… and that is what they hate because they don’t know what you are really imagining, feeling, truly thinking and deciding. So while you still can… imagine and think critically… and feel the emotions and wonder what such a little one and a kiss could mean? Discern all things and ask the Holy Spirit to show you what is and what is not a truth.

KEEP ON PRESSING INTO THE KINGDOM OF GOD! PRESS, PRESS, PRESS!

DIANNE